Glass repair insurance provides financial protection against unexpected glass damage, saving money and preserving vehicle value through proactive maintenance. It covers repairs or replacements with minimal out-of-pocket costs, preventing simple issues from escalating into costly repairs. This peace of mind allows drivers to focus on their daily lives without worrying about glass-related problems.

Glass repair insurance is a smart investment for homeowners and businesses, offering significant long-term savings. Understanding the cost of glass damage, from broken windows to shattered doors, reveals a potential financial burden. This article explores the benefits of glass repair coverage, demonstrating how it provides peace of mind and prevents escalating expenses. By addressing glass damage promptly, policyholders can avoid costly replacements and reduce the risk of further harm. Embrace the security and affordability that glass repair insurance offers.

- Understanding the Cost of Glass Damage

- The Benefits of Glass Repair Insurance

- Long-Term Savings and Peace of Mind

Understanding the Cost of Glass Damage

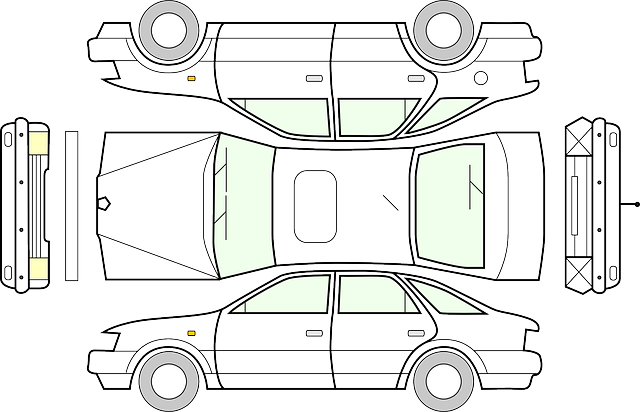

Glass damage can significantly impact your finances, often in unexpected ways. The cost of replacing or repairing cracked, chipped, or shattered windows extends beyond just the price of materials. It includes labor fees, which can vary based on the complexity and location of the damage, as well as potential hidden costs like temporary accommodations if your vehicle is rendered unsafe for driving after the incident.

Additionally, frequent glass repairs without proper coverage can accumulate, straining your budget over time. This is where glass repair insurance plays a crucial role in mitigating these expenses. By including this type of coverage in your insurance policy, you gain peace of mind and financial protection against unexpected glass damage, whether it’s to your car bodywork or other vehicles and structures. Opting for glass repair insurance can save you from the long-term burden of frequent payments towards glass repairs, making it a wise investment for anyone prioritizing cost-efficiency and financial security.

The Benefits of Glass Repair Insurance

Glass repair insurance offers a range of benefits that can significantly reduce long-term expenses for vehicle owners. One of its key advantages is financial protection against unexpected and costly glass damage. Cracked, broken, or stolen car windows can lead to substantial repairs or replacements, which can be a financial burden. With the right coverage, these incidents become manageable, as insurance policies often cover these expenses entirely or with minimal out-of-pocket costs.

Additionally, this type of insurance can enhance overall vehicle maintenance. By providing peace of mind regarding glass repair or replacement costs, drivers are more likely to address smaller issues promptly, preventing them from escalating into bigger, pricier problems over time. This proactive approach to car bodywork, similar to how regular mercedes benz repair maintains a vehicle’s optimal condition, ensures that the vehicle retains its value and remains safe for years to come.

Long-Term Savings and Peace of Mind

Investing in glass repair insurance offers a myriad of benefits that extend far beyond just financial coverage. One of the most significant advantages is the potential for long-term savings, which can be a game-changer when it comes to managing vehicle repairs. By having this type of insurance, you’re safeguarding yourself from the often hefty costs associated with unexpected glass damage. This proactive approach ensures that a simple cracked windshield or shattered side window doesn’t turn into a costly ordeal.

Moreover, glass repair insurance provides peace of mind, knowing that your vehicle is protected against such unforeseen events. It allows drivers to focus on their daily lives and driving experiences without the constant worry of what to do if something goes wrong with their car’s glass. Whether it’s a minor chip or a full fender repair (including glass replacement), having insurance coverage can prevent a simple issue from escalating into a more expensive Mercedes Benz repair or, for that matter, any vehicle repair.

Glass repair insurance isn’t just a convenience; it’s a strategic investment. By proactively addressing potential glass damage, this coverage offers significant long-term savings by mitigating expensive replacements. It provides peace of mind, knowing that unexpected breaks or cracks are covered, preventing substantial financial burdens associated with frequent glass repairs. Embracing glass repair insurance is a sensible step towards responsible home or vehicle maintenance, ensuring your spaces remain secure and your expenses remain manageable.